Technical Documentation

Version

1.1 � May 2025

REST API

API Usage

Our API is

based on a REST service and uses standard HTTP response codes to indicate

errors that occur when making API requests.

Our responses are served in JSON format, including

responses containing error messages.

An example of

a successful example is as follows:

An error

response will have a similar structure:

For the API

to accept the requests you make, they must be properly authenticated.

In the following section we explain how to authenticate the requests to our

API.

Such responses may not always have the same structure

due to progressive changes that may include new fields within the API response.

It is therefore recommended not to strictly validate the entire response.

API error codes

The codes that can be received from the endpoints will

be the following:

|

Code |

Message |

Explanation |

|

200 |

OK |

Everything worked as expected |

|

400 |

Bad Request |

The request was

unacceptable, often due to missing a required parameter |

|

401 |

Unauthorized |

No

valid API key provided |

|

402 |

Failed |

The requested

resource doesn't exist |

|

403 |

Unauthenticated |

Api

key or signature are incorrect or they are not being sent as they should |

|

404 |

Not Found |

The parameters

were valid but the request failed |

|

409 |

Conflict |

The

request conflicts with another request |

|

429 |

Too Many Requests |

Too many requests

hit the API too quickly |

|

500 |

Server Errors |

Something

went wrong on services end |

|

502 |

Server Errors |

Something went

wrong on services end |

|

503 |

Server Errors |

Something

went wrong on services end |

|

504 |

Server Errors |

Something went

wrong on services end |

Concepts

Environments

We have two different environments to make requests

to: Sandbox and Production. Each of these

environments must be called with different data, i.e. the API KEY,

the service, order or card identifiers will be different

depending on the environment in which the call is made.

The Sandbox environment

is an environment created for system testing. This environment is usually used

for gateway integration, and all operations performed in this environment are

done through the test services, so payments made through this

environment do not handle real money.

In this

environment, specific test cards must be used, in order to control the

different responses that can be received (SUCCESS, ERROR...).

The URL of this environment is: https://api.paylands.com/v1/sandbox/

The Production environment

is the final environment of the system. All payments made in this environment

are handled with real money. Therefore, since transactions in this environment

already contact the issuing bank of the cards used, they must be real cards.

The URL of this environment is: https://api.paylands.com/v1/

Operational

The

operations indicate the types of payments that can be made through the

platform.

The type of operative is specified by

the operative attribute in the order

creation call to /payment. Once the order operation

has been configured, the request must be sent to the corresponding endpoint to

perform the subsequent actions.

Authorization

Collection

order effective at the time of the transaction.

|

Code |

Description |

|

AUTHORIZATION |

Performs a payment on the created order. The URL is /payment/direct |

|

REFUND |

Performs a total

or partial refund of a payment. The URL is /payment/refund |

Deferred

Allows a

charge to be sent for later confirmation. It does not perform any check or

debit.

|

Code |

Description |

|

CONFIRMATION |

Enforces

the previously held charge. The URL is /payment/confirmation |

|

CANCELLATION |

Releases the

previously held amount (if not yet confirmed). The URL

is /payment/cancellation |

|

REFUND |

Performs a full or partial refund after a confirmation of a hold. The URL is /payment/refund |

Order status

During the

payment process, orders change status to reflect information about the payment,

that information is in the status field of

the order object.

The Order status can have the following values:

|

Value |

Description |

|

BLACKLISTED |

Operation

rejected by the black list |

|

CANCELLED |

Preauthorization cancelled by client |

|

CREATED |

Payment Order Initiated |

|

EXPIRED |

Transaction that

has been too long on card hold |

|

FRAUD |

Transaction

rejected by the anti-fraud system |

|

PARTIALLY_REFUNDED |

Partially refunded transaction |

|

PARTIALLY_CONFIRMED |

Preauthorization partially confirmed |

|

PENDING_CONFIRMATION |

Preauthorization

that has placed a hold on the user's account and is waiting for the customer

to confirm the hold |

|

REFUNDED |

The

transaction has been returned |

|

SUCCESS |

Successfully completed transaction |

|

REFUSED |

Transaction rejected by bank |

|

PENDING_PROCESSOR_RESPONSE |

Transaction

without 3DS that has been sent to the processor |

|

PENDING_3DS_RESPONSE |

User is on 3DS |

|

PENDING_CARD |

User is on the

payment card inserting his card |

|

USER_CANCELLED |

The

user has canceled the payment from the payment card |

|

REDIRECTED_TO_3DS |

Payment has been

attempted but for security reasons the user must manually authorize the

payment. |

|

AUTHENTICATION_REQUIRED |

The

bank has required authentication for this transaction and is waiting for the

user to access the 3DS |

|

PENDING_PAYMENT |

The user has

provided all the necessary data to carry out the payment and is awaiting

confirmation from the payment provider. |

|

THREEDS_EXPIRED |

The

transaction has arrived on 3DS but the user has abandoned the process, and

has not been authenticated |

Transaction status

Like orders,

transactions also reflect transaction status information in

the status field of the transaction object.

These are the values you can find in a Transaction:

|

Value |

Description |

|

CREATED |

When

we have not yet received a response from the acquirer with the final result

of the transaction. |

|

SUCCESS |

The transaction

has arrived at the processor and has been successfully completed. |

|

REFUSED |

The

transaction has arrived at the processor but has been completed incorrectly

(incorrect card, insufficient funds, etc.). |

|

ERROR |

The transaction

could not be completed due to an error in the service configuration. |

|

PENDING |

When

the transaction is pending to be validated by the processor |

|

CANCELLED |

When the

transaction has been rejected by the processor. |

Authentication

When using

the API you will need to authenticate your API calls with your API Key in every

request. Your API Key implies many privileges, so make sure to keep it secret.

Do not share your API Key nor expose it to the client or within a public

website.

API

authentication is based on HTTP Basic Auth. API Key must be sent as the value

for the username field. It is not necessary to send any value for the password

field. If this header is set manually, API Key must be base64 encoded.

In case you

need to authenticate using bearer auth (as a cross-origin request, for

example), include the modifier -H "Authorization: Bearer "

instead of -u:.

All API calls

must be performed under HTTPS. HTTP requests and unauthenticated calls will be

denied.

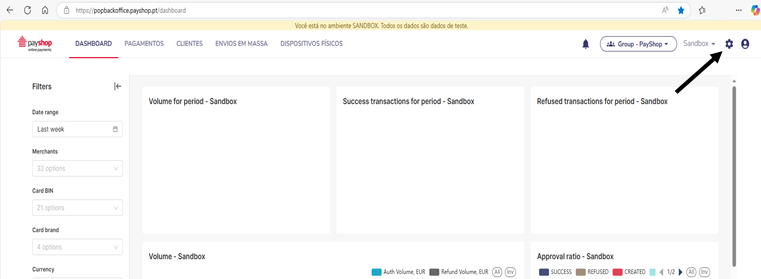

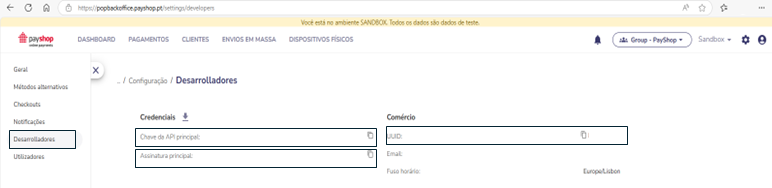

You can find

your merchant API Key in the POP

Backoffice.

Clicking on Desarrolladores will display your credentials.

API key

profiles

The API key has

several profiles assigned to it that determine its permissions. Information

about the different API key

profiles and how to get them can be found in the API

Reference.

Payment methods

MB WAY

Using this

payment method, the user will receive a PUSH notification on his cell phone

that will allow him to make the payment through his bank's application. There

are two ways to integrate it: by redirection or push payment.

Integration by redirection

To integrate

by redirection, the user must be present at the time of payment, which must be

processed through a browser. First we must generate a payment order optionally

indicating the user's phone number so that the user does not have to fill it

in.

To obtain the

service identifier, the service_uuid of the

SIBS service, contact contato.pop@payshop.pt

Once the

order is generated, the user must be redirected to the payment screen indicating

the token of the order and in the query, the name of the APM:

We construct

the redirection URL by replacing the token of the order

returned from the previous call.

https://api.paylands.com/v1/sandbox/payment/process/{token}?apm=MBWAY

Once the user

is redirected to this screen, they will receive the notification on their cell

phone. When they complete the payment, they will be redirected back to the OK

or KO URL, depending on the result of the payment.

Push payment integration

If on the

other hand we do not want to require the user to be present at the time of

payment, this payment method can be integrated via push payment.

To do this,

we must first generate a payment order Mandatory with

the user's first name, last name and telephone number. If you do not have the

user's name and surname, you can send an empty string in these fields.

Next,

the push payment request must

be launched indicating the UUID of the order. Then the user will receive the

push notification on his cell phone, and once he completes the payment, the

merchant will receive the payment notification to the URL indicated in the

field `url_postundefined when generating the payment

order.

Multibanco is

an alternative payment method exclusive to Portugal that we offer through SIBS,

which allows payments to be made at an ATM or through the bank's mobile

application in which the user indicates the reference that they have obtained

during the payment process.

There are two

ways to integrate it: by redirection or push payment.

Integration via redirection

To integrate by

redirection, the user must be present at the time of payment, which must be

processed through a browser. First we must generate a payment order.

To obtain the

service identifier, the service_uuid of the

SIBS service, contact contato.pop@payshop.pt

Once the

order is generated, the user must be redirected to the payment screen indicating

the token of the order and in the query, the name of the APM:

We constructed the redirection URL by replacing

the token of the order returned from the previous call.

Once the user

is redirected to this screen, they will be able to view the reference to be

entered through his/her bank's mobile application or physically through an ATM.

When the payment is completed, they will be redirected back to the OK or

KO URL, depending on the result of the payment.

Push payment integration

If the merchant

prefers to send the reference to the user through a channel other than the

browser, it is possible to integrate the push payment method, which will return

the reference to the server so that it can be sent to the user.

To do this,

we must first generate a payment order.

Then we must launch the push payment request indicating the UUID of the order. The response will contain the payment reference and payment deadline. These fields are included within the payment transaction, in the field payment_data. An example is included below:

Once the payment is completed, the merchant will

receive the payment notification to the URL indicated in the url_post field when generating the payment order.

Custom fields

By default,

there is no set deadline. If you want to customize this value, just add this

information when generating

the payment order with the desired date

in Y-m-d format:

Referência Payshop

Payshop is

an alternative payment method exclusive to Portugal which allows you to make

payments in more than 5000 authorized merchants. All you must do is enter the

13-digit reference number and hand over the cash to complete the purchase.

There are two

ways to integrate it: by redirection or push payment.

Integration by redirection

To integrate

by redirection, the user must be present at the time of payment, which must be

processed through a browser. First we must generate a payment order.

To

obtain the service identifier, the service_uuid of

the PAYSHOP service, contact contato.pop@payshop.pt

Once the order

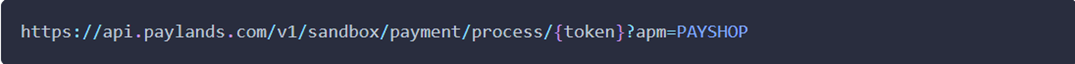

is generated, the user must be redirected to the payment screen indicating

the token of the order and in the query, the name of the APM:

We construct the redirection URL by replacing

the token with the value returned in the previous call.

Once the user is redirected to this screen, he/she

will be able to view the reference. The reference could be paid in one of the

5000 Payshop Agents. When the payment is

completed, he/she will be redirected back to the OK or KO URL, depending on the

result of the payment.

Push payment integration

If the

merchant prefers to send the reference to the user through a channel other than

the browser, it is possible to integrate the push payment method, which will

return the reference to the server so that it can be sent to the user.

To do this,

we must first generate a payment order.

Then we must launch the push payment request indicating the UUID of the order. The response will contain the payment reference and payment deadline. These fields are included within the payment transaction, in the field payment_data. An example is included below:

Once the

payment is completed, the merchant will receive the payment notification to the

URL indicated in the `url_postundefined field when

generating the payment order.

Custom fields

By default, the expiration date is set within 3 days

from the moment the payment is triggered. If you want to customize this value,

just add the following information when generating the payment order indicating

with the desired date in Ymd format. Its

value must be equal to or greater than the current date:

You should specify the maximum number of payments that

can be made with the same reference by specifying the maxNbrPayments field.

Its value must be 1.

"extra_data":

{

"payment": {

"maxNbrPayments": "1"

}

}

Card (not present)

Simple integration

The

redirection payment card is the simplest and safest way to collect payments

from your customers. They are shown a screen with a form for them to enter

their card details. This can be done through a redirect or by showing them the

form embedded in a iframe on your

website.

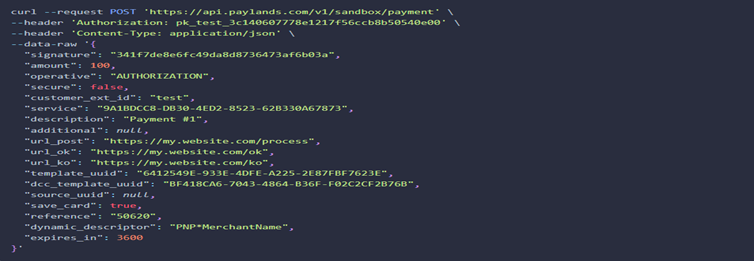

1. Generate the payment order on your server

The merchant

must send the payment characteristics to the /payment endpoint

(amount, service, urls, ...) to generate the order.

Our API returns an order object together with an order TOKEN that will be used

to redirect to the payment letter to finalize the payment.

The complete

specification for Generate payment order can

be found in the API Reference.

2. Redirect the customer to the payment letter form.

In the

response of the previous call to /payment we have the TOKEN we need

to redirect the user to the payment letter form.

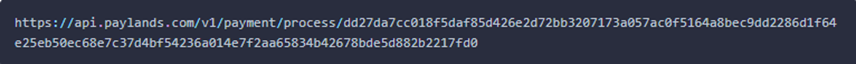

The URL of

the payment letter the merchant should redirect to

is /payment/process/{TOKEN} looking like this:

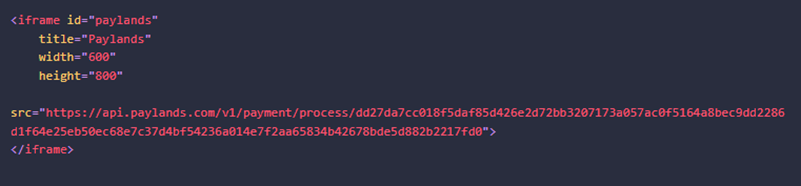

The merchant

can simply redirect the navigation to this URL or embed in an iframe the URL to simulate that the navigation continues on

your site.

3. The customer completes the payment and your server is

notified.

Customer

enters credit card information (and other payment information depending on the selected

payment method) and goes through the 3D secure verification process (is

redirected to the page provided by the credit card issuing bank for transaction

confirmation) if necessary.

Then Payshop receives the data, processes it and issues a

notification to the merchant at the url specified in

the url_post field along with the

updated order object with the result of the transaction.

4. The client is redirected back to your server

Then redirects the user to the corresponding url according to the result of the operation:

- If the payment was successful,

the user is redirected to the url specified in

the url_ok field.

- In any other case, the user is

redirected to the url specified in the url_ko field.

Payment notification

Example of a notification received

{

"message": "OK",

"code": 200,

"current_time":

"2022-11-16T11:16:33+0100",

"order": {

"uuid":

"D16004FF-3421-409C-ADFC-DA2618D36135",

"created": "2022-11-16T11:11:03+0100",

"created_from_client_timezone":

"2022-11-16T12:11:03+0200",

"amount": 1050,

"currency":

"978",

"paid": true,

"status":

"SUCCESS",

"safe": true,

"refunded": 0,

"additional":

"227610373340",

"service":

"CREDORAX",

"service_uuid":

"B1F13B01-BA97-491C-BBDE-1C18988BD229",

"customer":

"user42",

"cof_txnid":

"202232016000606",

"transactions": [

{

"uuid":

"2343BE77-1383-491E-8D95-5E00F0D35FAA",

"created": "2022-11-16T11:11:15+0100",

"created_from_client_timezone":

"2022-11-16T12:11:15+0200",

"operative": "AUTHORIZATION",

"amount": 1050,

"authorization": "651979",

"processor_id":

"XZZ01d4d229b0d5dB40RPKQCOSFNBGBH",

"status": "SUCCESS",

"error": "NONE",

"source": {

"object": "CARD",

"uuid": "F1E73ECB-D88C-4C57-919E-102F0E822416",

"type": "CREDIT",

"token": "95d37eaa18762d7d8c7b4ef098c4dd1e55450f21a9efaea27466d42da183b21b6cf3d0d8b74001b17ee3ba7d23e1daba7dda9b54a37979f3bb7cebc6e18ee7fe",

"brand": "VISA",

"country": "MT",

"holder": "Miguel C",

"bin": 401881,

"last4": "0036",

"is_saved": true,

"expire_month": "12",

"expire_year": "34",

"additional": null,

"bank": "BANK OF VALLETTA P.L.C",

"prepaid": false,

"validation_date": "2022-11-16

11:12:02",

"creation_date": "2022-11-16

11:11:51",

"brand_description": null,

"origin": "PAYMENT_CARD",

"cof": {

"is_available": true

}

},

"antifraud": null,

"device": {

"fingerprint": "495973560",

"user_agent": "Mozilla\/5.0 (X11;

Linux x86_64; rv:106.0) Gecko\/20100101 Firefox\/106.0"

},

"error_details": null,

"bizum": {

"account": "ES51XXXXXXXXXXXXXXXX0001",

"phone_number": "346XXXXX306"

}

}

],

"token": null,

"ip":

"127.0.0.1",

"reference": null,

"dynamic_descriptor":

null,

"threeds_data":

{

"version": "2.1",

"flow": "FRICTIONLESS",

"sca_requested": false,

"status": "Y",

"eci": "06",

"exemption": null

},

"dcc": {

"fee": "3.00 %",

"change": 0.099415,

"mode": "LOCAL",

"selection": "CARD",

"card_currency": "NOK",

"merchant_currency": "EUR",

"ecb_change": null

}

},

"client": {

"uuid":

"42B8CF56-A7D7-4D4A-8349-4E27263CB2D5"

},

"extra_data": {

"halcash":

{

"sender_name": "sender",

"secret_key": "1234",

"expiry_date": "2022-11-11"

}

},

"validation_hash":

"8fe27963c7dd6c134dfd09fca6e544942acf89a57c8488c6437ca9c355397250"

}

Whitelist IPS

Firstly, you

can whitelist the IPs coming from our servers. This is one of the most common

and simplest solutions.

To do so,

contact contato.pop@payshop.pt

to receive the IPs.

Validation using the hash of the notification

The other way

to check that the communication between Payshop and

the merchant is not being intercepted is by checking the validation hash. Once

the request to Payshop has been processed, a json response like the one below will be returned.

The extra_data field will only appear if it was included in the

initial request.

After

fetching the received json from the notification, we

must calculate a hash using the signature credential.

First of all,

we must extract the order, client and extra_data fields

from the received notification and store them in an array. Then we json encode this array and calculate the hash using the SHA

256 algorithm and the signature as described in the example below.

As mentioned

before, the extra_data field may not appear

if it was not sent in the initial request sent by the merchant.

Notifications of expired orders

To enable

this option you must contact contato.pop@payshop.pt and

request to enable Notify expired orders.

After

enabling this feature, whenever the order status is changed to expired, a

notification will be sent to the merchant to the url

specified in the url_post field along with

the updated order object:

The complete

specification for Generate payment order can

be found in the API Reference.